Chart of the Week – Good Closes

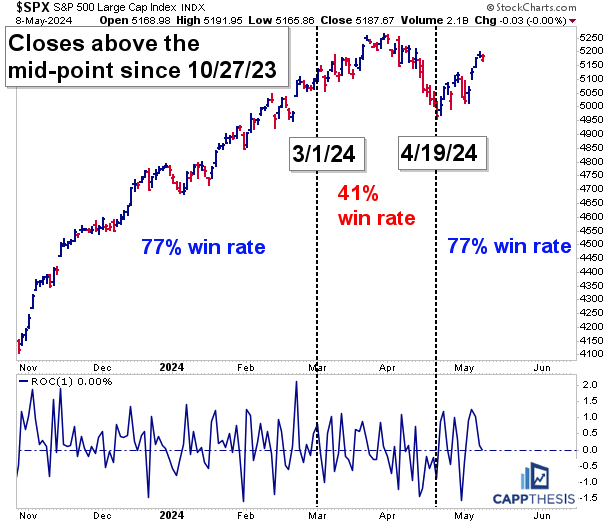

🟢The SPX just closed above its intra-day mid-point for the 10th in the last 13 trading sessions (a 77%-win rate).

🔴 Even more striking, this has happened right after the worst span of intra-day action over the last six months: From 3/4/24 through 4/19/23, the SPX closed above its mid-point just 41% of the time.

🟢 This was a distinct change of character from what occurred from the October low through March 1st when the index gained nearly +30%. During that persistent uptrend, the SPX finished well very often. How well? 77% of the time. Yes, the exact same rate as now.

From this perspective, the SPX is right back to where it was during the uptrend.

Interviews, articles and social media:

CNBC Pro Article

https://www.cnbc.com/2024/05/08/bank-stocks-seem-poised-for-a-breakout-according-to-the-charts.html

YouTube

https://www.youtube.com/watch?v=GLt-Luxea5Q&t=45s

Barron’s

https://www.barrons.com/articles/stock-market-dow-s-p-500-c91e79fe

CappNotes

Monday

UNLOCKED Opening Look: Three Important Next Steps

https://cappthesis.com/newsletter/three-important-next-steps/

CappThesis Premium Content:

Starter & Professional

Monday

Opening Look: Three Important Next Steps

Tuesday

Opening Look: Best 3-Day Run… of 2024

Wednesday

Opening Look: Chart Rundown

Thursday

Opening Look: Good Closes are Back

Friday

Opening Look: Another Potential Bullish Pattern

Professional Only

Sunday

PostScript: Week Ending 5/3/24

Thursday

Chart Trades – Eight Bullish Bank Charts

Friday

Breaking Out (Video)

Client calls