SPX Approaching a Key Level

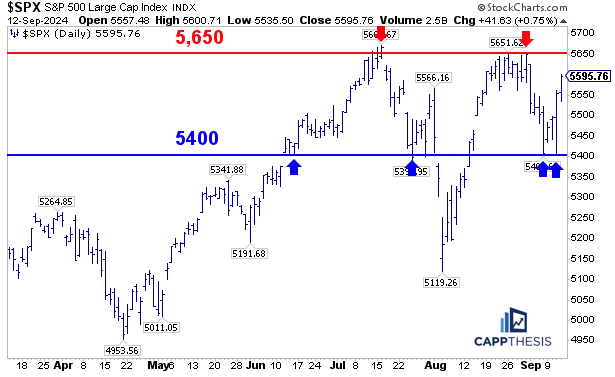

As we know, the market’s real move happened on Wednesday with the huge positive reversal session. The SPX had just hit 5,400 for the second time in three days and looked ready to crack. It didn’t, and now the index is up nearly 4% from Wednesday’s low point.

5,400 has proven to be important more than once over the last few months. In fact, since first overtaking the 5,400-level, the SPX has held on retests of the support area four different times. Again, two of those occasions have occurred in September already.

The one time that 5,400 gave way was in early August, and it coincided with the biggest multi-day decline we’ve seen in 2024.

In terms of resistance, the index has faded the two times it has tested 5,650 – mid-July and then again in late August into early September. However… if/when that level is overtaken, a big bullish formation could be taken advantage of…

…like this, which is an updated chart of the current potential cup and handle pattern, which connects the July and August highs.

The would-be breakout line has a slight downward slope, but finally overtaking it will yield a lofty upside target if it happens.