Topics Reviewed:

1- SPX Performance

2- Patterns

3- Breadth

4- Sector ETFs: XLF Financials

5- Best & Worst 20 ETFs

6- US Dollar

7- XLP Consumer Staples

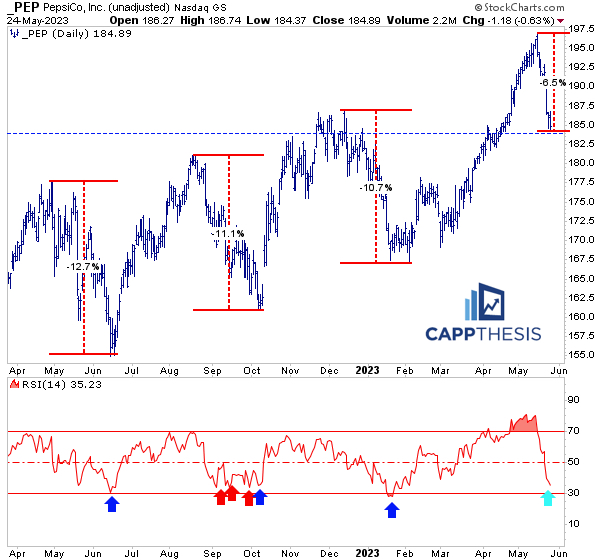

8- PEP Pepsico

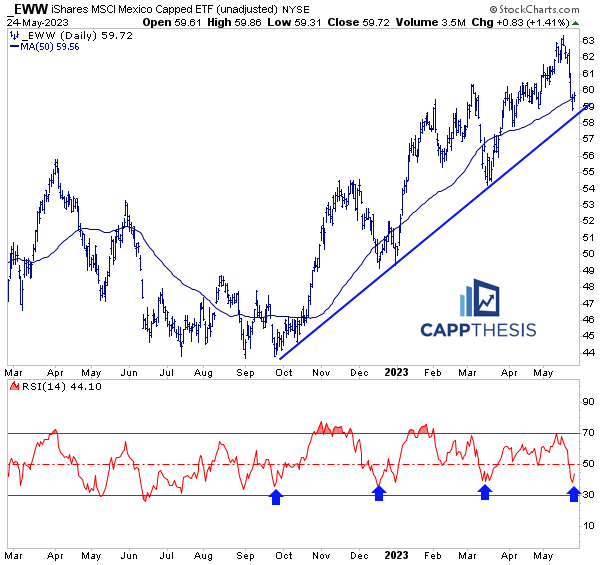

9- EWW Mexico

10- MUB Muni Bonds

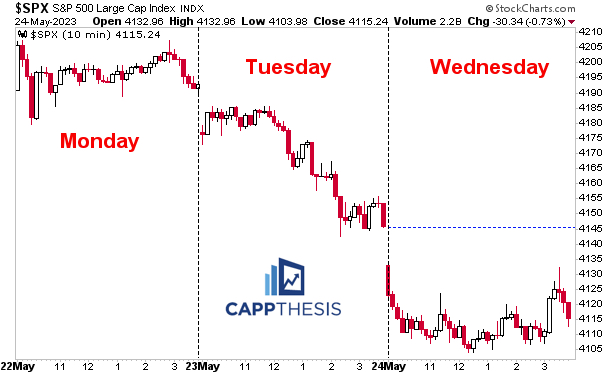

1-Performance

The SPX avoided its second straight 1% decline today, which only has happened once this year so far… 3/9 – 3/10. It wasn’t a valiant effort, especially with the final fade halting what looked like a spike into the close.

Overall, the index was net-flat for the final six hours. Of greater significance, it now has closed below its intra-day mid-point for the fourth straight session.

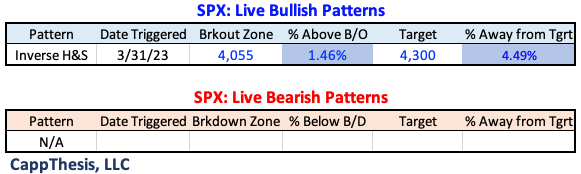

2-Patterns

The SPX’s 3/31 breakout remains in play for now.

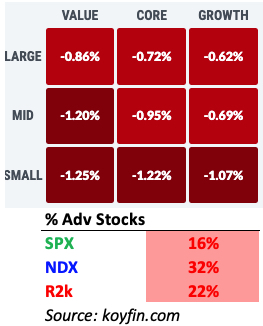

3-Breadth & Style

While still noticeably negative, the NDX actually had the “best” breadth today among the major indices, with some (not all) of its biggest names helping.

4-Sectors

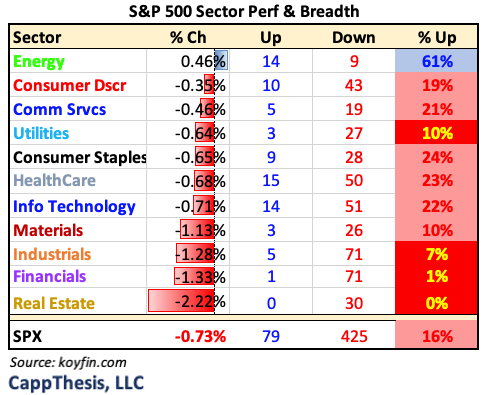

10/11 Sector ETFs finished lower for the second straight day, with Energy bucking the trend and leading again, especially from the internals perspective. Four (non-growth) sectors had 90% negative breadth readings.

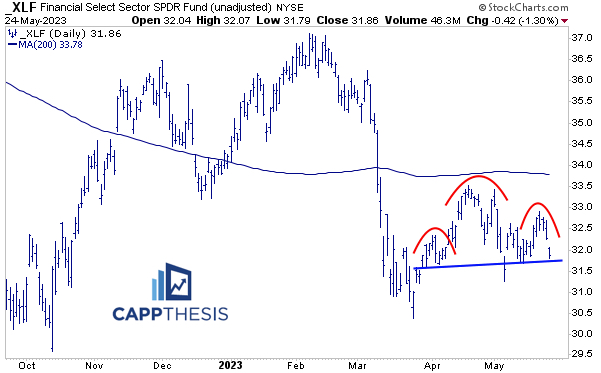

XLF Financials was among four sector ETFs to drop at least 1%, and its breadth numbers were conspicuously worse than most of the other sector ETFs. It’s now sporting a clear double top-like pattern. Holding above the 31.5 zone now is very important.

5- Best and Worst 20 ETFs

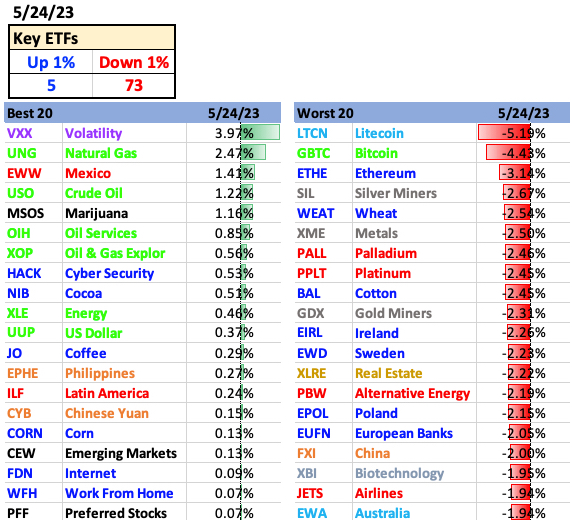

Big decliners again convincingly outpaced big gainers, with only the Energy-related equity ETFs making respectable showings as a group.

6-US Dollar

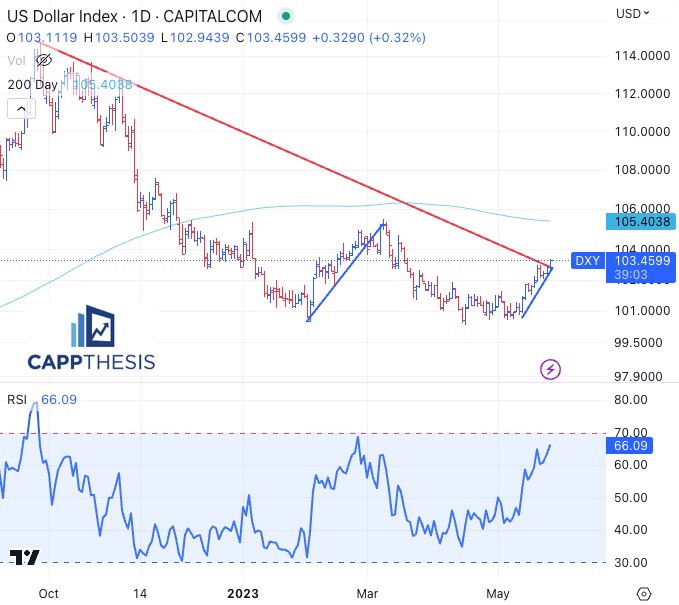

The US Dollar notched a gain for the sixth time in the last seven days, pushed through the downtrend line from the 2022 highs, and its 14-d RSI now is at 66, the highest level since 2/24.

That last advance eventually lost steam when the short-term uptrend line was breached, which is something we should watch for again now.

7- XLP Consumer Staples

XLP fell for the seventh time in the last eight sessions today and now is close to support, its 200-Day MA and the uptrend line cited on Monday. Its 14-D RSI also got to nearly oversold territory today for the first time since late October. In other words, it appears short-term washed out and potentially ready to mount a bounce attempt.

8-PEP PepsiCo

PEP is XLP’s second biggest component, with a 10% weighting (PG is 14%). Thus, its undeterred two-month uptrend through early May was a major reason for XLP’s spring advance. Likewise, the sizable downturn the last two weeks has been a huge factor.

The decline (finally) pulled the RSI back from the mid-70s, which now sits at 35. It’s not quite oversold yet, and the 6.5% drawdown is less than prior pullbacks… But with the long-term uptrend still in play, it could attract dip buyers again soon.

9-EWW Mexico

EWW was one of just four ETFs we track to finish UP today. If its uptrend is for real, then this could be another buying opportunity: it’s pushing back above its 50-D MA, held its uptrend line and is coming off an RSI that nearly hit oversold territory – all of which led to rallies three prior times.

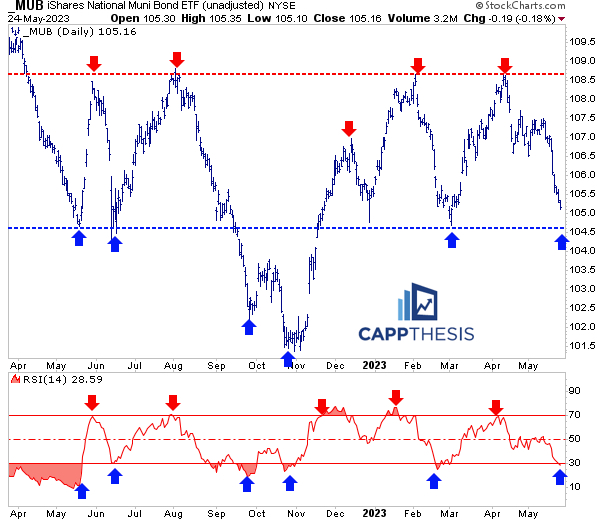

10-MUB Muni Bonds

MUB Muni Bonds is nearing a clear support zone and now is oversold again – two conditions that led to multi-week bounces over the last 12 months.