Key Points:

1– The SPX now has had two weekly declines in the last 16 weeks. The last time we saw two straight weekly losses was during the period ending 10/27/23 – the low.

2- The SPX now has seen five absolute 1% moves in the last 13 trading days, which is the most since it had five in seven days from 10/25 – 11/2/23.

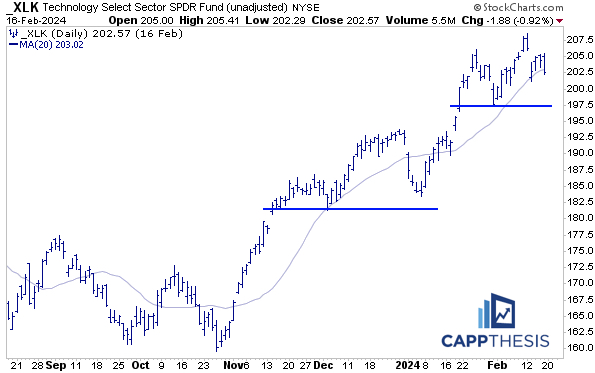

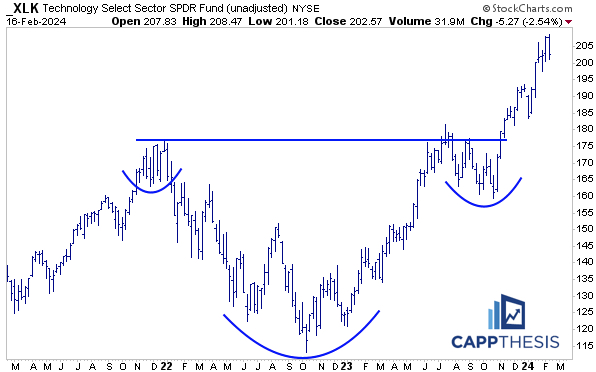

3- XLK Technology was the worst performing sector last week (-2.5%) and now is flirting with the 20-day moving average, with short-term support from late January not too far away (near 197). A similar bearish set up was in the works as 2023 ended and 2024 began…

Topics Covered:

Market

-SPX Weekly

-Pullback scenarios

-New highs vs. new lows

-Pattern update

-AVWAP

Stats

-Daily Price Action

-Index Breadth

-Sector Performance

-Best & Worst ETFs

Key Charts

-10-Year Yield

-US Dollar

-XLE (2)

–XLK (2)

Weekly Stats

Index Breadth

Full Weekly Perf Breakdown

SPX:

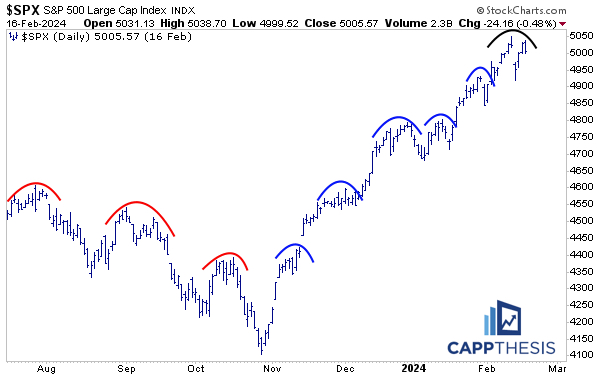

The SPX comes into the holiday-shortened week after a volatile few days, courtesy of successive 1% declines and advances last Tuesday and Wednesday. And while few people were around to see it, Friday’s afternoon sell-off killed the index’s five-week winning streak.

SPX Weekly

That’s now two weekly declines in the last 16 weeks. The last time we saw two straight weekly losses was during the period ending 10/27/23 – the low.

The SPX remains inside the long upward sloping channel we talked about last week, but it got close to breaking below the lower threshold with the CPI Day-induced sell-off last Tuesday.

Pullback Scenarios

Again, it would surprise no one to finally get a drawdown greater than 2%…

…and updating what a pullback scenario would look like from here, a drop back to the major breakout zone near 4,600 would amount to an 8.7% decline. The 38.2% retracement of the entire October’22 – February’24 advance would be approximately -11.7%.

Those are potentially big down moves, especially when compared to the infinitesimal pullbacks over the last four months. But as the chart shows, the persistent advance has left few traces of formidable near-term support.

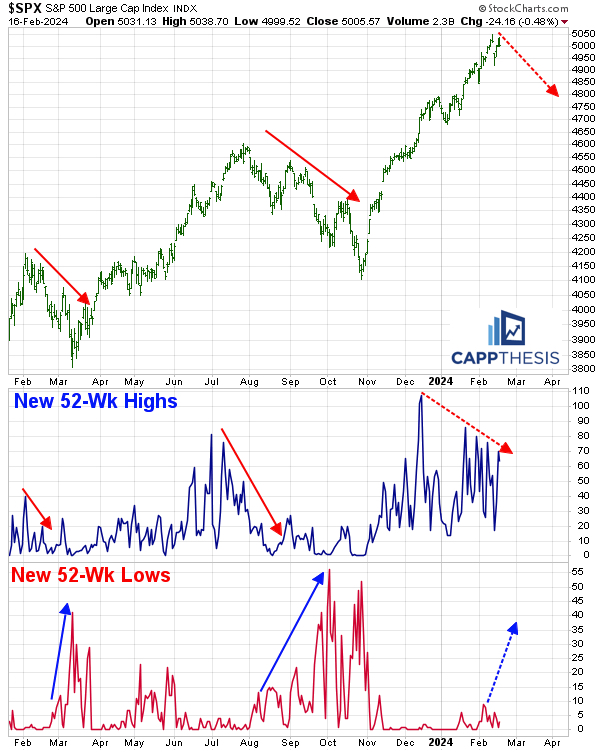

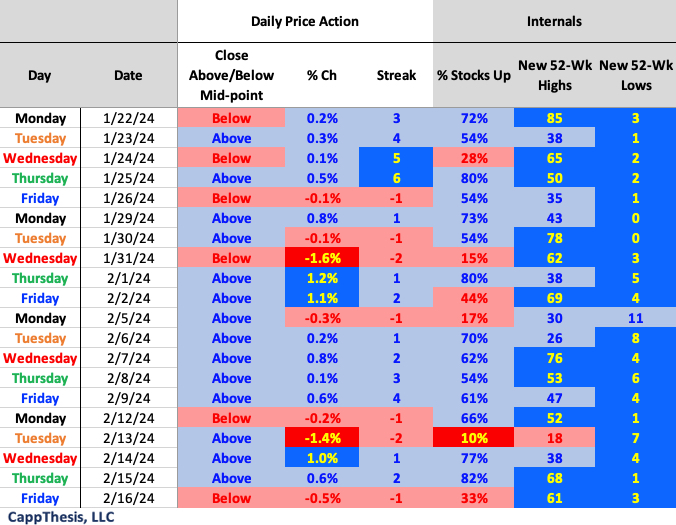

New Highs vs. New Lows

We continue to watch the number of new 52-week highs and new lows in the S&P 500, as well. Not much has changed in February yet. As the SPX has made intermittent new highs, between 70-80 of its holdings have made new highs along with it. That’s respectable, but still noticeably below the high of 107 from 12/14/23.

The number of new lows hit a “high” of 11 early in February, but it’s been in the single digits since then.

This is important to keep on our radar screens though since eventually things will change. As noted recently, the number of new highs tends to top first, which eventually affects the index, with the number of new lows materially rising as the market continues to decline.

For all of that to happen, we’d need a major shift in the pattern work, which has been decidedly bullish since November…

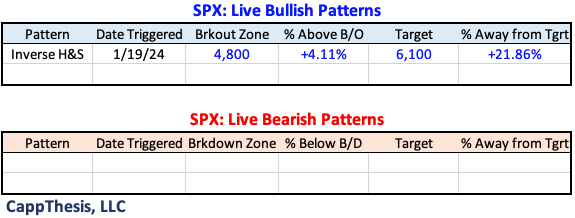

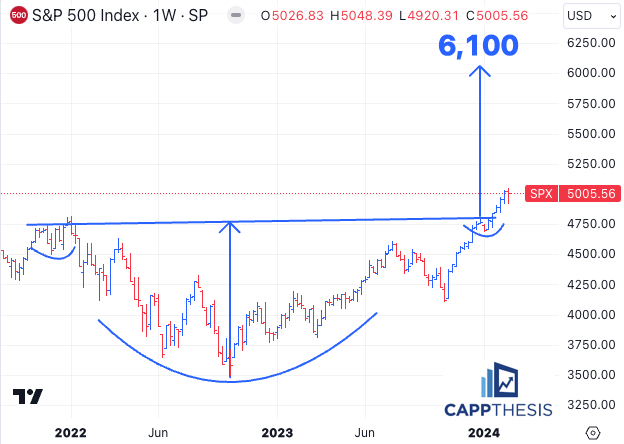

Patterns

The SPX remains 4% above the big bullish pattern’s 4,800 breakout zone. – target 6,100.

With the index shying away from the recent high near 5,050, this smaller potential bullish pattern hasn’t matured yet.

The bearish pattern scenarios we talked about post-CPI didn’t play out either, but as long as the SPX remains below its last peak, any lower high could set the stage for the next one.

SPY AVWAP

SPY remains above the VWAPs from the recent FOMC and CPI sell-offs.

SPY

Light Purple: 2/13/24 – CPI

Light Blue: 1/31/24 – FOMC

Yellow: 1/2/24 – YTD VWAP

Pink: 10/27 – October’23 low

Blue: 6/15 – FOMC negative reversal

Black: 8/18 – August low

Light Green 3/13 – March Low

Light Blue: 2/3 – Former high point

Red: 1/2/23 – Start of 2023

Purple: 1/4/22 – 2022 high

Green: 10/13/22 – 2022 low

Daily Price Action

The SPX now has seen five absolute 1% moves in the last 13 trading days, which is the tightest range since it had five in seven days from 10/25 – 11/2/23. This is important since clusters of emotional trading after long trends can sometimes lead to inflection points.

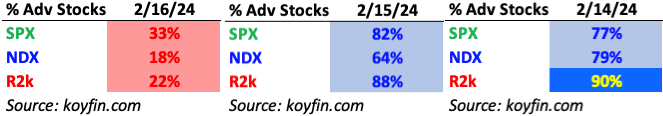

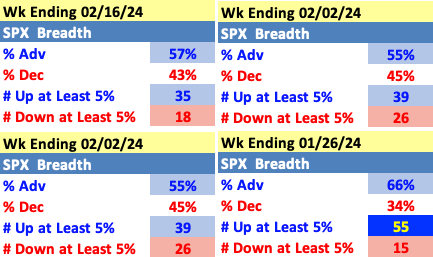

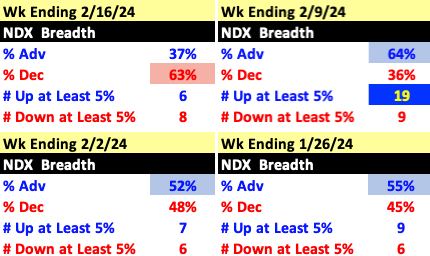

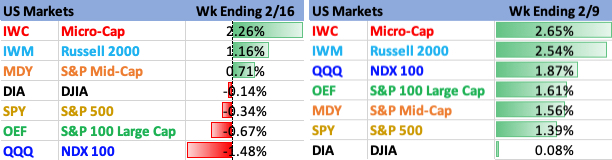

Breadth

SPX breadth remained marginally positive last week at 57%. However, just 37% of the NDX finished higher week over week – the worst weekly breadth ratio since the week ending 1/5/24, when just 16% stocks rose. See the weekly stats section below.

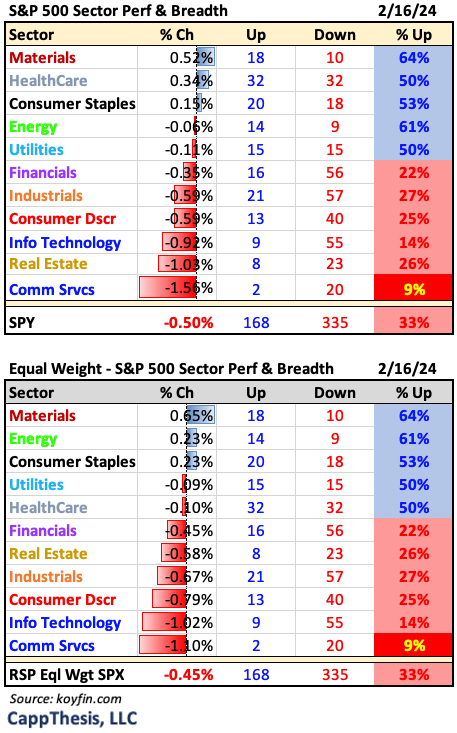

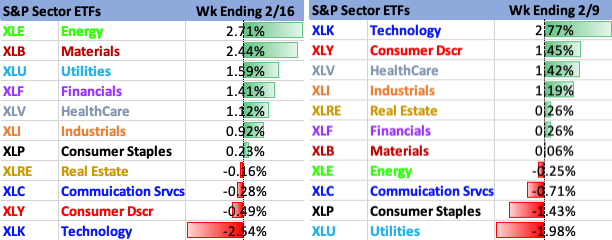

Sector ETFs

Three of the four worst sectors on Friday were growth – Consumer Discretionary, Tech and Comm Services.

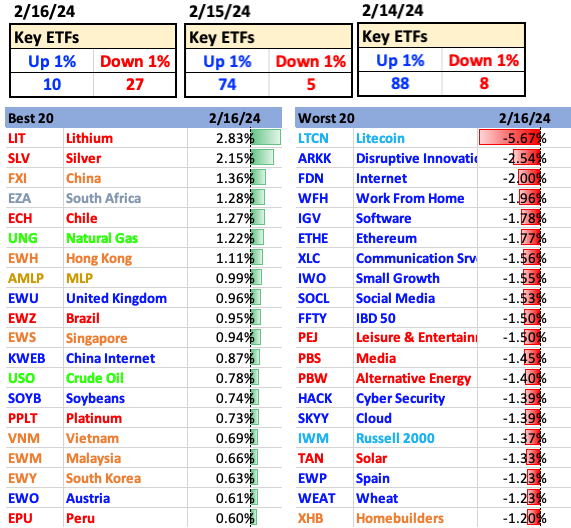

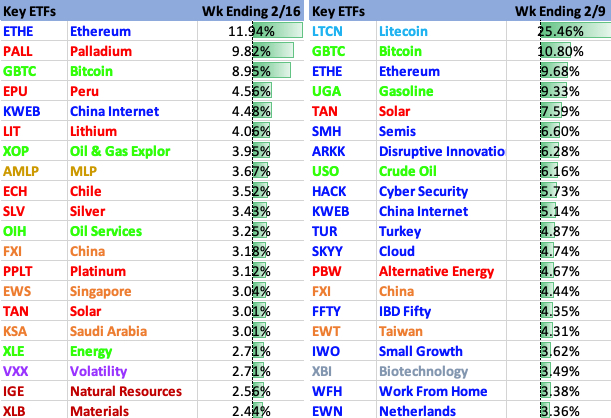

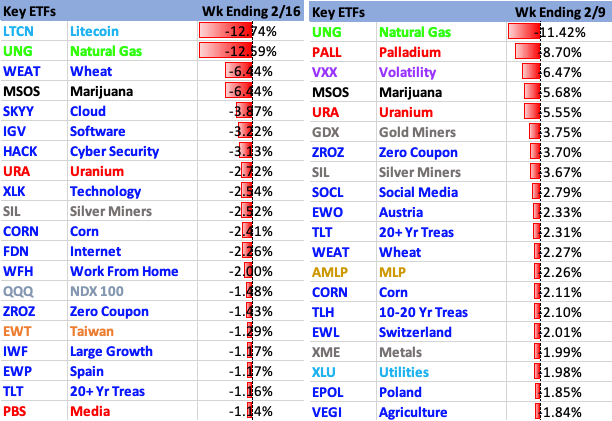

Best and Worst 20 ETFs

Growth underperformance was clear within our ETF list, as well.

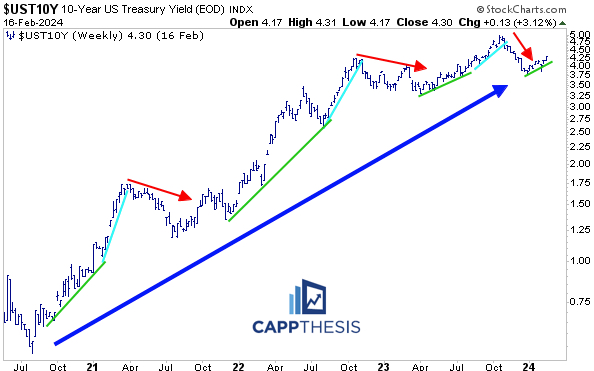

10-Year Yield

The 10-Year Yield ticked higher last week for the fourth time in five weeks. From this perspective, the long-term uptrend was not affected by the prior downturn late last year.

As we know, the SPX was able to rally for most of 2023 despite the upswing in rates, as well. But stocks did have trouble when said upswing steepened (light blue), which is something we’ll be closely watching from here.

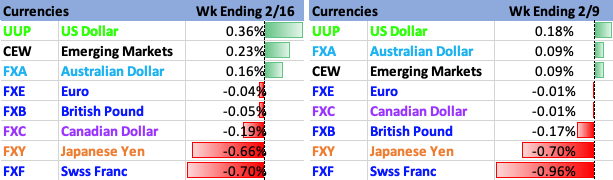

US Dollar

The Dollar rose for the seventh straight week, which now is the second longest winning streak since late 2021. Of course, this also hasn’t hurt stocks yet.

The difference so far is that the current advance has been more gradual: the weekly RSI still is in the 50s, which is where the indicator topped in the failed rallies from the first half of 2023.

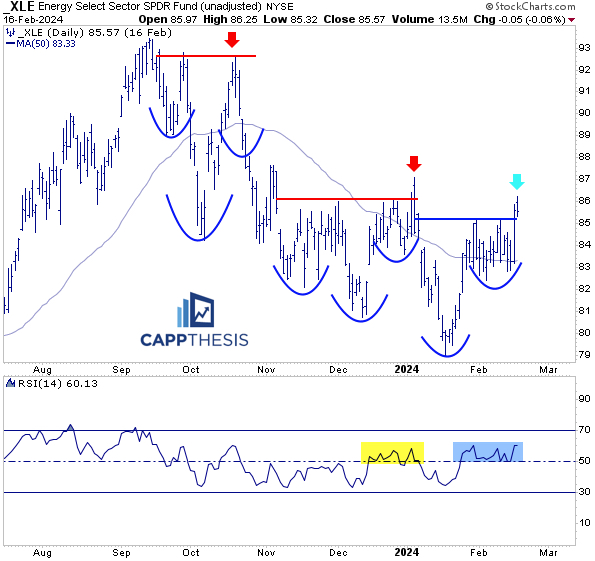

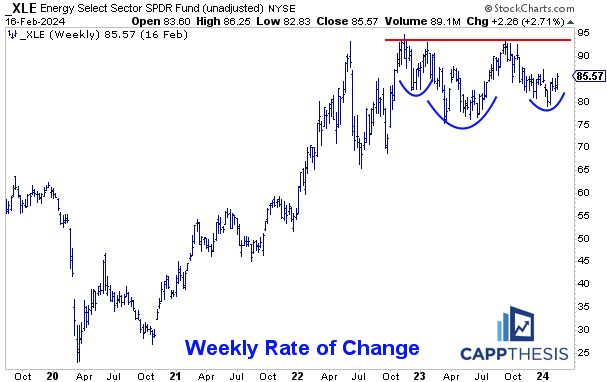

XLE Energy

XLE Energy led last week and now will be trying again to leverage a bullish pattern breakout.

If that finally plays out, XLE would have a chance to potentially make it back to the 2022 and 2023 highs. As is clear, that also would complete a larger bullish pattern – something to watch over the next few weeks.

XLK Technology

XLK was down 92 bps on Friday and -2.5% for the week – the worst performing sector over last five days. It’s now flirting with the 20-day moving average, with short-term support from late January not too far away (near 197). A potential drop to that zone would complete a bearish formation – if it happened soon.

A similar bearish set up was in the works as 2023 ended and 2024 began, which, of course, never played out. But with NVDA reporting tomorrow, a lot could change, especially in the daily work.

XLK’s weekly pattern breakout zone (major support) is down near 177.

SPX Breadth

NDX Breadth

Best 20

Worst 20

Major Indices

S&P 500 Sectors

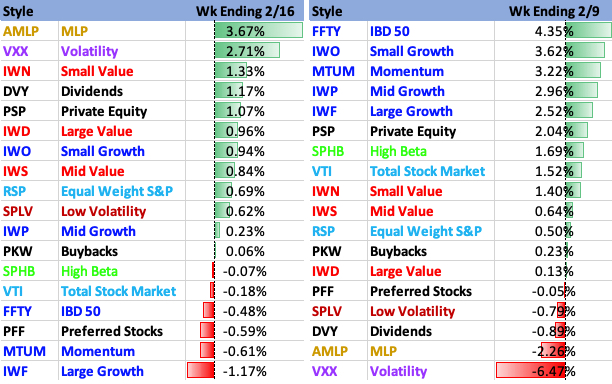

Style

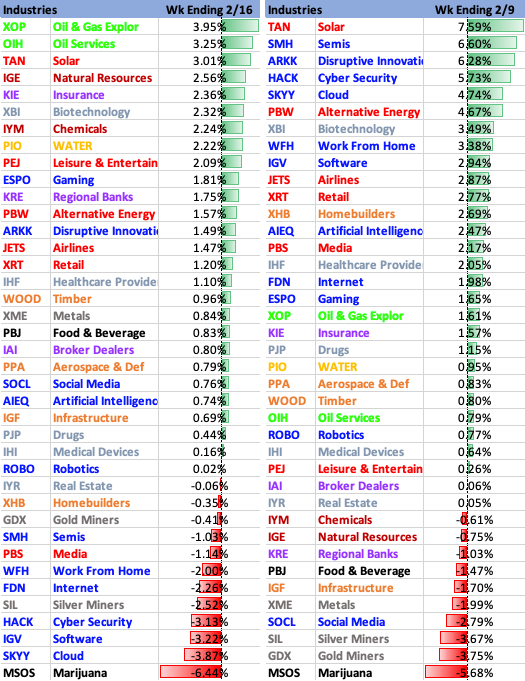

Industries

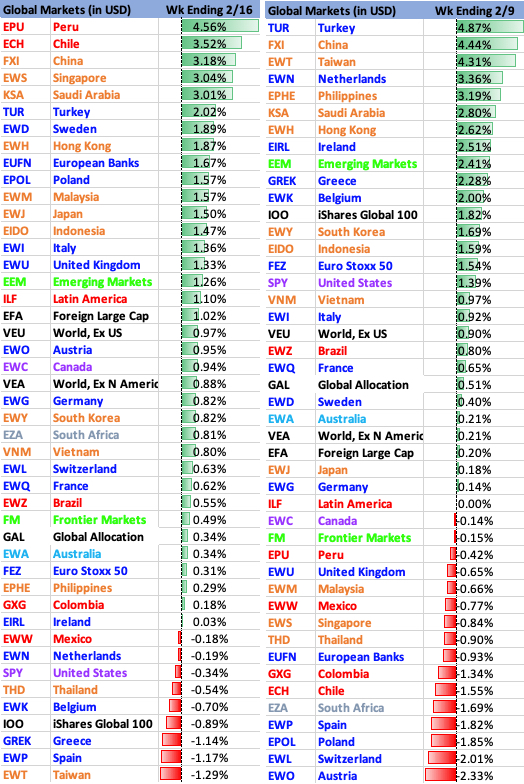

Global Markets

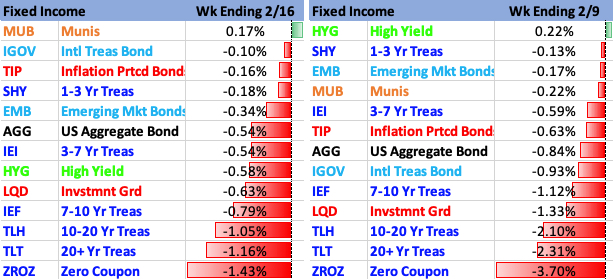

Fixed Income

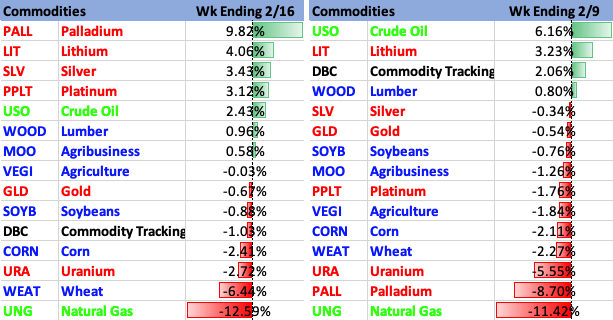

Commodities

Currencies

Crypto