For each buy idea, you’ll see:

1-the pattern in blue or green

2-target

3-the suggested stop in red

For each short idea, you’ll see:

1-the pattern in red

2-target

3-the suggested stop in blue

Buys

Bullish Pattern Breakouts

AAPL

Buy the dip in an uptrend

AMD

Severely oversold & near support

Shorts

Bearish Pattern Breakdowns

Short the rip in a downtrend

Overextended to the upside

Earnings

Bullish Pattern Breakouts

AAPL is up a cool 94% from its 2022 low, a run that now spans nearly 26 months. It’s beaten the SPX’s advance since then, which stands at+72%. But it has lagged the XLK Technology ETF (+110%), of which it was the biggest weight until this past June. That title was taken by NVDA during the rebalance. And NVDA is +1,200% since October’22…

So, AAPL may appear extended after yesterday’s push to new all-time highs, but not compared to its own sector. In fact, AAPL could be getting ready for another up leg after yesterday’s gain, which nearly triggered its first overbought reading since mid-July.

This first chart shows the last four occasions that AAPL’s 14-day RSI crossed the 70-level for the first time in at least two months.

Twice, the stock continued higher for much longer (blue dotted lines); the other two times, a sell-off soon resulted – right away in February’23 and within a few weeks after November’23 (red dotted lines). The common theme with both selloffs was that AAPL also failed at key resistance zones.

When the stock eventually broke out through those same areas of supply months later in April’23 and May’24, respectively, it extended much higher both times.

Most recently, a few weeks ago in October, AAPL failed to retake its July high. It’s now trying again…

…and if it can hold this move to new highs, the upside target would be up at 278. The aforementioned pattern breakouts also had targets that seemed lofty, but when AAPL finally broke out, it followed through immediately and those targets were both acquired.

AAPL next reports earnings on 1/30/25.

Buy the Dip in an Uptrend

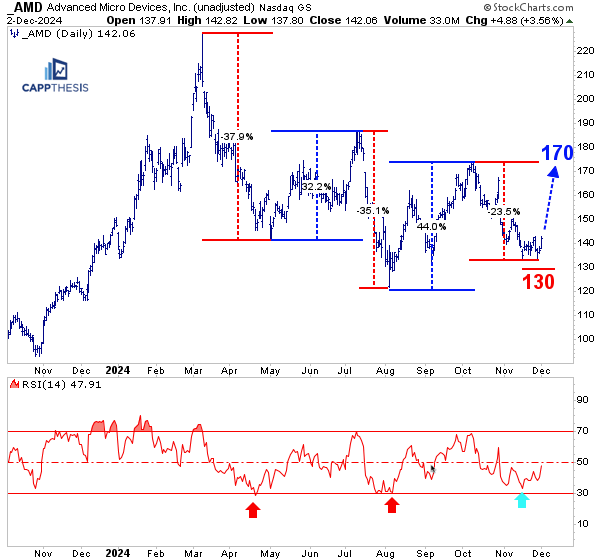

AMD has had a very challenging time since its spike high and monster negative reversal on 3/8/24. Its peak-to-tough decline got to -46%. And while it’s now off that August low, it has failed to garner much upside follow through.

However, along the way, AMD has experienced two very big mean-reverting rallies, totaling +32% and +44%. And with the stock’s recent hold above the 130 mark the last few weeks (and seeing its 14-day RSI avoid oversold territory this time), it could be getting ready for another rally attempt.

The initial target would be near 170, as the last two bounces failed to make higher highs. If/when it gets there, we’ll see if any bullish patterns are starting to form…

AMD also has respected two clear long-term trend lines (support) the last few weeks, which now have converged near the 130 zone, too. Those are the same lines that the stock rallied from in August and September.

AMD next reports earnings on 2/4/25.