Chart of the Week – Real Rotation

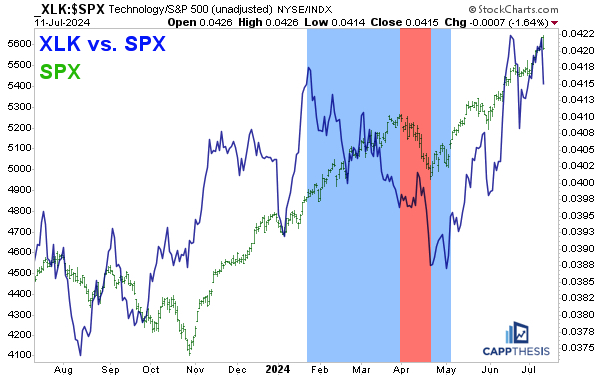

The rotation out of Tech and into everything else was widely discussed on Thursday: 80% of the SPX advanced as XLK fell 1.6%.

Indeed, one day doesn’t make a trend. But it’s been this way since the April lows. In fact, the S&P 500 now has had positive breadth for eight straight sessions on days in which Technology was the worst-performing sector.

Of course, mega cap growth has bounced back each time since then. It will be a different story if the latest downturn gives traders pause this time. And then we’ll see just how keen they are to rotate to other areas for a longer period.

The last time that Tech underperformed the SPX for an extended span was from late-January though early May.

That lasted 14 weeks (believe it or not), but the SPX declined in just three of them – during the spring 6% sell-off. In other words, the market has proven that it can rally without Tech before in 2024. It may have to prove itself all over again soon.

Interviews, articles and social media

CNBC Pro Article

Financial ETF nears substantial breakout, according to the charts

Barron’s

The Biggest Risk to the Mag 7 Is How Well They’re Doing

Schwab Network

Analyzing Market Performance of the S&P 500

YouTube

CappNotes

Wednesday: Six Straight Gains

CappThesis Premium Content

Starter & Professional

Monday

Opening Look: Eighth Pattern Target Hit

Wednesday

Opening Look: Six in a Row

Thursday

Opening Look: Bullish Stats

Friday

Opening Look: Tech Lags, Everything Else Rallies

Professional Only

Monday

Roadmap: Week of 7/8/24

Thursday

Breaking Out Video

Client meetings & calls